When it comes to storing your cryptocurrencies, you often have to make a choice between security and convenience. Crypto wallets are like a party for your blockchain transactions – they help you securely store and manage your digital assets.

There are different types of crypto wallets available, each with its own set of features and benefits. One of the most popular types is a self-custody wallet. With this type of wallet, you are in control of your private keys and have full ownership of your account. This means that you have complete control over your cryptocurrencies and can access them anytime you want.

Another type of crypto wallet is a custodial wallet. These wallets are usually provided by third-party services, like exchanges, and they hold your private keys on your behalf. While custodial wallets offer convenience and ease of use, they also come with some risks, as you’re relying on a third party to keep your funds secure.

Desktop wallets are another option when it comes to storing your cryptocurrencies. These wallets are installed on your computer and give you full control over your private keys. They offer a higher level of security compared to custodial wallets, as your private keys are stored locally on your device.

There are also mobile wallets, which are designed for use on smartphones and tablets. These wallets are connected to the internet and allow you to easily send and receive cryptocurrencies on the go. Mobile wallets are a popular choice for those who want to have access to their funds anytime and anywhere.

Regardless of the type of wallet you choose, it’s important to have a good know-how of how they work and how to use them securely. Cryptocurrencies can be stored safely and securely, as long as you take the necessary precautions and follow best practices.

In this blog, we will explore the different types of crypto wallets in more detail, highlighting their pros and cons, and giving you all the information you need to make an informed decision on which wallet is right for you.

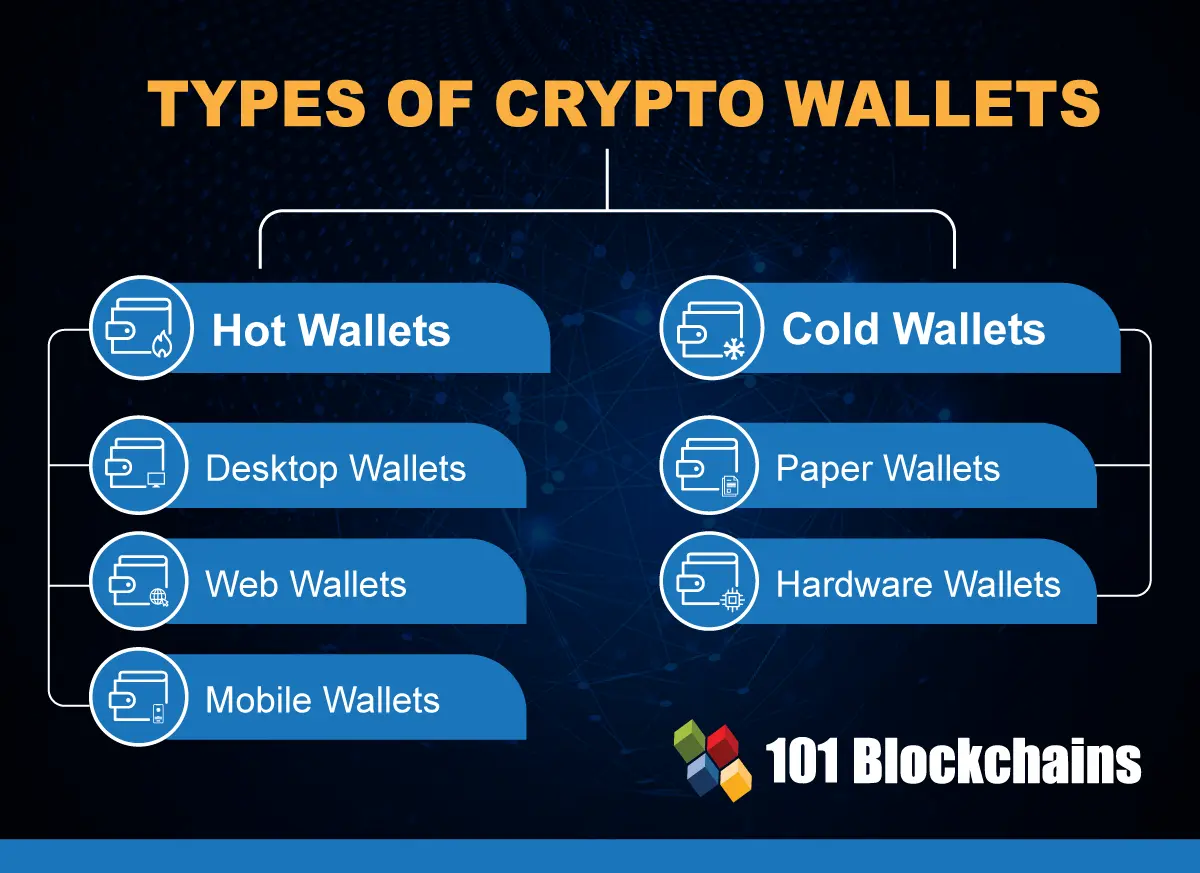

- Types of hot wallets

- Desktop wallets

- Web wallets

- Mobile wallets

- Web wallets

- Desktop wallets

- Types of cold wallets

- Hardware wallets

- Paper wallets

- Easy Ways to Convert Bitcoin to Cash Instantly

- 1. Use a Cryptocurrency Exchange

- 2. Use a Peer-to-Peer Trading Platform

- 3. Use a Bitcoin ATM

- 4. Sell Bitcoin to a Friend or Acquaintance

- Conclusion

- What is a Crypto Wallet? How do crypto wallets work?

- The best self-custody wallet for buying, storing, swapping, and spending crypto

- Subscribe to BitPay Blog

- Which crypto wallet should I choose? Cold Wallets vs Hot Wallets

- Cold Wallets

- Hot Wallets

- Conclusion

- Blockchain Education

- How to Buy Gold with Bitcoin + Ethereum and 16+ more Cryptocurrencies

- Frequently Asked Questions:

- What are the different types of crypto wallets available?

- What is a hardware wallet?

- What is a software wallet?

- What is a paper wallet?

- Which type of wallet is the most secure?

- What is the main advantage of using a software wallet?

- Video:

- Tangem is Trash! We should not use it! Review & Experiences on Tangem Crypto Wallet

- What Are Crypto Wallets Explained! (Best Crypto Wallets)

- Crypto Wallets Explained for Beginners | What are Crypto Wallets

Types of hot wallets

When it comes to storing your cryptocurrencies, there are a number of options available. In this blog post, we will explore the different types of hot wallets and how they work.

Desktop wallets

Desktop wallets are software applications that you install on your computer. They allow you to securely store your cryptocurrencies on your own device, giving you full control over your private keys. Desktop wallets are self-custody wallets, which means that you have complete control over your funds and are responsible for their security.

Pros:

- Full control over your private keys

- Securely store your cryptocurrencies on your own device

- Can support a wide range of cryptocurrencies

Web wallets

Web wallets are wallets that you can access through a web browser. They are often custodial wallets, which means that a third party holds and manages your private keys on your behalf. While they offer convenience and ease of use, they also come with a certain level of risk as you are relying on the security practices of the wallet provider.

Pros:

- Easily accessible from any device with an internet connection

- Simple and user-friendly interface

- Often support a wide range of cryptocurrencies

Mobile wallets

Mobile wallets are applications that you can install on your smartphone or tablet. They work similarly to desktop wallets, allowing you to securely store your cryptocurrencies on your own device. Mobile wallets are convenient for on-the-go transactions and can often support a wide variety of cryptocurrencies.

Pros:

- Portable and accessible anywhere

- User-friendly interface

- Securely store your cryptocurrencies on your own device

It’s important to note that while hot wallets offer convenience and ease of use, they are generally considered less secure compared to cold wallets. Hot wallets are connected to the internet, which makes them more susceptible to hacks and malware. Therefore, it’s always important to take appropriate security measures and use trusted wallet providers when using hot wallets.

Web wallets

Web wallets are online wallets that operate through a web-based interface. They are accessible from any device with an internet connection, making them convenient for users who want to access their cryptocurrencies on the go. Web wallets are often provided by third-party services that manage the wallet for you.

When using web wallets, you don’t have full control over your private keys, as the custodial service holds them on your behalf. This means that if the custodial service is hacked or goes offline, you may lose access to your funds. However, web wallets are typically user-friendly and don’t require much technical know-how to use.

The main advantage of web wallets is their ease of use. You can quickly create an account, deposit your cryptocurrencies, and start transacting. Web wallets are also connected to the blockchain, allowing you to perform transactions in real-time.

On the downside, web wallets are susceptible to security breaches. Since your private keys are held by a third party, there is always a risk of them being compromised. Additionally, if you forget your login credentials or the custodial service goes out of business, you may lose access to your funds.

When choosing a web wallet, it’s important to consider the reputation and security measures of the custodial service. Look for web wallets that offer two-factor authentication, encryption, and other security features to protect your funds.

In summary, web wallets offer convenience and accessibility, making them a popular choice for users who are new to cryptocurrencies or prefer the convenience of managing their funds through a web interface. However, they come with the risk of losing control over your private keys and potential security vulnerabilities.

Desktop wallets

A desktop wallet is a type of cryptocurrency wallet that is installed and securely stored on a desktop computer or laptop. These wallets allow users to securely store and manage their cryptocurrency holdings.

Desktop wallets are often connected to the internet, which allows users to send and receive cryptocurrencies using their account.

There are two main types of desktop wallets: custodial and non-custodial. Custodial wallets are provided by third-party companies, and they store and manage the users’ private keys on their servers. On the other hand, non-custodial wallets give users full control over their private keys, ensuring a higher level of security.

In terms of pros and cons, desktop wallets have a number of advantages. They typically offer more features and functionalities compared to other types of wallets. Users can easily manage multiple cryptocurrencies, view transaction history, and access advanced options.

However, the main disadvantage of desktop wallets is that they are connected to the internet, which makes them more vulnerable to hacking attacks. If a user’s computer is not adequately protected, their cryptocurrencies could be at risk of being stolen.

When it comes to choosing a desktop wallet, it’s crucial to do your research and choose a reputable wallet provider. It’s also essential to regularly update your software and use strong security measures to protect your funds.

Most desktop wallets work by generating a unique set of private keys that are stored on the user’s computer. These keys are used to sign transactions and provide access to the user’s cryptocurrencies. It’s important to keep these keys secure and back them up in case the computer is lost or damaged.

While desktop wallets offer a high level of security, they also require some technical know-how to set up and use properly. If you’re new to cryptocurrencies and self-custody, you may want to start with a more user-friendly wallet.

Overall, desktop wallets are a popular choice for cryptocurrency holders who want to have full control over their funds and access advanced features.

Types of cold wallets

When it comes to storing your cryptocurrencies securely, there are several types of cold wallets that you can choose from. Cold wallets are offline wallets that are not connected to the internet, making them highly secure and less susceptible to hacking or theft.

The most common types of cold wallets are:

- Hardware wallets: Hardware wallets are physical devices that store your private keys offline. They often look like USB drives and work by generating and storing your private keys offline. This type of wallet is considered one of the most secure options as it offers strong protection against hacking and malware.

- Paper wallets: Paper wallets are physical printouts of your private and public keys. They can be generated offline and are not connected to the internet. Paper wallets are a good option for long-term storage, but they can be easily lost or damaged if not stored properly.

- Offline software wallets: Offline software wallets are desktop applications that generate private keys offline. They are typically used by people who have more technical know-how and want to securely store their cryptocurrencies on their own computer.

Each type of cold wallet has its pros and cons, so it’s important to consider your needs and preferences before choosing one. Hardware wallets offer the highest level of security but can be more expensive. Paper wallets are affordable but can be easily lost or damaged. Offline software wallets provide a balance between security and usability, but require more technical knowledge to set up and use.

If you’re new to cryptocurrency and want a simple and secure way to store your assets, a hardware wallet or paper wallet may be the best option. However, if you’re more experienced and comfortable with technology, an offline software wallet may work well for you.

No matter which type of cold wallet you choose, always remember to keep your private keys safe and never share them with anyone else. These keys are the only way you can access and manage your cryptocurrencies, so losing them can result in permanent loss of your assets.

Hardware wallets

A hardware wallet is a type of cryptocurrency wallet that allows you to store your cryptocurrencies securely and maintain self-custody of your assets. Unlike software wallets that work on desktop or mobile devices, hardware wallets are physical devices that securely store your private keys offline.

The way hardware wallets work is by generating and storing your private keys on the device itself. When you want to make a transaction, you connect the hardware wallet to a computer or mobile device and authorize the transaction using your private keys. This way, your private keys are never exposed to third-party software or online platforms.

Hardware wallets offer a number of advantages:

- Security: Hardware wallets provide an extra layer of security as the private keys are stored offline and are less vulnerable to hacking or malware attacks.

- Custodial control: With a hardware wallet, you have full control over your cryptocurrencies. You don’t have to rely on third-party custodial services to secure your assets.

- Ease of use: Hardware wallets typically come with user-friendly interfaces and are easy to set up and use, even for beginners.

- Compatibility: Most hardware wallets support multiple cryptocurrencies, so you can store different types of cryptocurrencies in one device.

- Backup and recovery: Hardware wallets usually come with backup and recovery options, so even if you lose or damage your device, you can still access your funds.

One thing to keep in mind when using a hardware wallet is that you should always buy it from a reputable source to ensure its authenticity and security. Additionally, it’s important to keep your recovery phrase or seed phrase in a safe place, as losing it could result in permanent loss of access to your cryptocurrencies.

If you’re interested in learning more about hardware wallets and how to use them, you can find detailed instructions and tutorials on the manufacturer’s website or on various cryptocurrency blogs and forums. By familiarizing yourself with the know-how of using hardware wallets, you can ensure the secure storage of your cryptocurrencies and have peace of mind knowing that your assets are well protected.

Paper wallets

Paper wallets are a type of cryptocurrency wallets that have been around since the early days of Bitcoin. They are considered one of the most secure ways to store your cryptocurrencies.

Paper wallets work by generating a pair of public and private keys offline. The public key is used to receive funds, while the private key is used to access and spend those funds. Since the keys are created offline, they are not connected to the internet and are thus less vulnerable to hacking and other online threats.

The main advantage of paper wallets is their simplicity and security. Paper wallets are often recommended for long-term storage of large amounts of cryptocurrencies. They provide a high level of self-custody, as you have control over the private keys.

However, paper wallets also have their downsides. If you lose your paper wallet, all the funds stored in it will be lost forever. Paper can degrade over time, so it’s important to store your paper wallet in a safe and dry place. Additionally, if you’re not familiar with the technical know-how of creating and using paper wallets, it can be a bit complicated.

There are a number of online services and software wallets that allow you to generate and print your own paper wallets. These wallets often come with instructions on how to securely create and use paper wallets. However, it’s important to do your research and choose a reputable provider, as there have been cases of fraudulent paper wallet generators.

In summary, paper wallets are a secure way to store your cryptocurrencies, as long as you follow the necessary precautions. They provide a high level of self-custody and are often recommended for long-term storage. However, they require some technical know-how and can be easily lost if not stored properly.

Easy Ways to Convert Bitcoin to Cash Instantly

If you often work with cryptocurrencies, you may find yourself in a position where you need to convert Bitcoin to cash. This can be done through various methods and platforms, depending on your needs and preferences. In this article, we will explore some easy ways to convert Bitcoin to cash instantly.

1. Use a Cryptocurrency Exchange

One of the most common ways to convert Bitcoin to cash is by using a cryptocurrency exchange. These platforms allow you to trade your Bitcoin for fiat currencies, such as USD or EUR. The process typically involves creating an account on the exchange, depositing your Bitcoin, and selling it for cash.

Some popular cryptocurrency exchanges where you can convert Bitcoin to cash include Coinbase, Binance, and Kraken. These platforms often offer a user-friendly interface and a number of different trading pairs, making it easy to convert your Bitcoin to cash.

2. Use a Peer-to-Peer Trading Platform

If you prefer to transact directly with another party, you can use a peer-to-peer trading platform. These platforms connect buyers and sellers, allowing you to trade Bitcoin for cash without the involvement of a third party. This method can be more private and may offer competitive exchange rates.

Some popular peer-to-peer trading platforms include LocalBitcoins, Paxful, and Bisq. These platforms typically offer a messaging system and an escrow service to ensure safe transactions.

3. Use a Bitcoin ATM

Bitcoin ATMs are another convenient option for converting Bitcoin to cash. These machines allow you to withdraw cash by selling your Bitcoin. Simply locate a Bitcoin ATM near you, follow the instructions displayed on the screen, and insert the amount of Bitcoin you want to convert. The machine will dispense cash instantly.

Bitcoin ATMs can be found in various locations, such as airports, malls, and convenience stores. You can use websites or mobile apps to find the nearest Bitcoin ATM to your location.

4. Sell Bitcoin to a Friend or Acquaintance

If you know someone who is interested in buying Bitcoin, you can sell it directly to them. This method allows for a more personal and potentially flexible transaction. However, it’s important to set clear terms and ensure that both parties are comfortable with the transaction.

When selling Bitcoin to a friend or acquaintance, you can use a hardware wallet or a mobile wallet to securely transfer the Bitcoin. Make sure to follow best practices and double-check wallet addresses to avoid any mistakes.

Conclusion

Converting Bitcoin to cash can be easily done using various methods and platforms. Whether you choose to use a cryptocurrency exchange, a peer-to-peer trading platform, a Bitcoin ATM, or sell to a friend, it’s important to prioritize security and follow best practices to ensure a smooth transaction. Consider the pros and cons of each method and choose the one that best suits your needs and preferences.

What is a Crypto Wallet? How do crypto wallets work?

A crypto wallet is a secure digital wallet used to store, send, and receive cryptocurrencies. It is essentially a software application that allows you to interact with various blockchain networks and manage your cryptocurrency holdings.

Crypto wallets can be classified into two main types: custodial and self-custody wallets.

Custodial Wallets:

Custodial wallets are provided by third-party companies and exchanges. When you want to store your cryptocurrencies, you typically create an account with the custodial wallet provider. The provider takes care of securing your private keys and holds your cryptocurrencies on your behalf. Some examples of custodial wallets are wallets provided by cryptocurrency exchanges like Binance or Coinbase.

The pros of custodial wallets are that they are usually easy to use and manage. The wallet provider takes care of security and backups, making it a convenient option for beginners who may not have much technical know-how.

Self-Custody Wallets:

Self-custody, or non-custodial wallets, give you full control and ownership of your private keys and cryptocurrencies. These wallets require you to take responsibility for securely storing your private keys. Self-custody wallets can be further categorized into different types:

- Desktop Wallets: These wallets are installed on your personal computer and allow you to manage your cryptocurrencies offline. Desktop wallets are considered more secure than online wallets as they are not connected to the internet when not in use.

- Mobile Wallets: These wallets are mobile applications that can be installed on your smartphone. They offer convenience and portability as you can access your cryptocurrencies on-the-go.

- Hardware Wallets: These wallets are physical devices that store your private keys offline. They provide the highest level of security as they are immune to malware and hacking.

When using a self-custody wallet, it is crucial to back up your private keys securely. If you lose your private keys, you may lose access to your cryptocurrencies permanently.

In summary, crypto wallets work by storing the private keys required to access and manage your cryptocurrencies securely. Custodial wallets are provided by third-party companies and handle the security for you, while self-custody wallets require you to take full responsibility for the security of your private keys. It is important to choose a wallet that suits your needs and level of technical expertise.

The best self-custody wallet for buying, storing, swapping, and spending crypto

When it comes to securely managing your cryptocurrencies, self-custody wallets are typically considered the best option. Unlike custodial wallets, self-custody wallets give you full control over your funds and are connected directly to the blockchain.

Self-custody wallets can be desktop-based applications or online wallets that you access through a web browser. They are designed to keep your private keys secure, ensuring that only you have access to your funds. This eliminates the risk of losing your crypto due to the hacking or bankruptcy of a third-party custodian.

One of the most popular self-custody wallets is the XYZ Wallet. It is known for its user-friendly interface and robust security features. Whether you want to buy, store, swap, or spend your crypto, XYZ Wallet has you covered.

XYZ Wallet works by generating a unique set of private and public keys for each user. These keys are stored securely on your device, ensuring that only you have access to them. In addition, XYZ Wallet encrypts your data and utilizes multi-factor authentication to provide an extra layer of security.

One of the major advantages of using self-custody wallets like XYZ Wallet is that you have full control over your funds. You can easily manage multiple cryptocurrencies within a single wallet and track your transactions using the built-in tools.

Another benefit of self-custody wallets is that they are often more secure than custodial wallets. With a self-custody wallet, you are not relying on a third-party to protect your funds. Instead, you are taking responsibility for your own security by securely managing your private keys.

However, it’s important to note that using self-custody wallets requires some technical know-how. You need to be familiar with how wallets and private keys work, as well as how to securely store and backup your keys. If you are new to cryptocurrencies, it is recommended to do some research and educate yourself before diving into self-custody wallets.

In summary, if you want to securely buy, store, swap, and spend crypto, a self-custody wallet like XYZ Wallet is the best option. With full control over your funds and robust security measures, you can be confident that your cryptocurrencies are in safe hands.

Subscribe to BitPay Blog

If you want to stay connected with the latest information and updates about different types of crypto wallets, subscribe to the BitPay Blog. BitPay is a renowned platform that comes with a number of wallet options for securely storing your cryptocurrencies.

While there are many wallets available out there, some are more suitable for self-custody, where you have full control of your wallet, while others may be more custodial, where a third party manages your wallet on your behalf.

If you’re new to the world of crypto and don’t have much know-how about how wallets work, using a custodial wallet can be a good option. These wallets are typically easy to set up and use, making them ideal for beginners.

However, if you value the security and control of your assets, then a self-custody wallet is what you need. These wallets often require more technical knowledge, but they provide you with complete ownership and control over your funds.

The BitPay Blog offers detailed information on various wallet types, including both custodial and self-custody options. You can learn about the pros and cons of each type and choose the one that best suits your needs and preferences.

Another important aspect that the BitPay Blog covers is the blockchain technology behind these wallets. Understanding the blockchain can help you make informed decisions about how you want to store and manage your cryptocurrencies.

Don’t miss out on the latest updates and valuable insights. Subscribe to the BitPay Blog today and stay informed about the different types of crypto wallets and how to make the most of them.

Which crypto wallet should I choose? Cold Wallets vs Hot Wallets

If you’re new to the world of cryptocurrencies, it’s important to understand the different types of wallets available and choose the right one for your needs. When it comes to crypto wallets, there are two main categories: cold wallets and hot wallets.

Cold Wallets

A cold wallet, also known as a hardware wallet, is a physical device that securely stores your private keys offline. This means that even if your computer or smartphone gets lost or is connected to the internet, your cryptocurrencies will still be safe.

With a cold wallet, you have full self-custody over your crypto assets. You can securely store your private keys and have complete control over your funds. When you want to make a transaction, you need to connect your cold wallet to a computer or smartphone and sign the transaction using your private keys.

The main advantage of cold wallets is their high level of security. Since they are not connected to the internet, they are immune to online threats such as hacking or malware attacks. They are often considered the most secure way to store your cryptocurrencies.

However, cold wallets also have some drawbacks. They require some technical know-how to set up and use. They can be expensive compared to other types of wallets. Also, if you lose your cold wallet or forget the recovery phrase, you may permanently lose access to your account.

Hot Wallets

A hot wallet, on the other hand, is a crypto wallet that is connected to the internet. Hot wallets can be further categorized into web-based wallets, mobile wallets, and desktop wallets.

The advantage of hot wallets is that they are easy to use and accessible from anywhere as long as you have an internet connection. They are often free or have low fees associated with them and don’t require much technical know-how to set up and use.

However, hot wallets are generally considered less secure than cold wallets. Since they are connected to the internet, they are more vulnerable to online threats. If a third party gains access to your private keys, they can easily steal your cryptocurrencies. Therefore, it is essential to choose a reputable hot wallet provider with good security measures in place.

Conclusion

When choosing a crypto wallet, consider your security needs, technical know-how, and convenience. If you want the highest level of security and don’t mind the extra complexity and cost, a cold wallet may be the best choice. On the other hand, if you prioritize convenience and ease of use, a hot wallet can be a suitable option, just make sure to choose a reliable provider with good security measures.

Blockchain Education

When it comes to cryptocurrencies, often people want to have control over their own funds and not rely on third-party custodial wallets. This is where blockchain education becomes important.

Most people know how to work with desktop wallets or online wallets, but they may not have the know-how to securely manage their own self-custody wallets. Self-custody wallets are wallets where you have complete control over your own private keys.

There are a number of different types of wallets to choose from, and each has its own pros and cons:

- Online wallets: These wallets are connected to the internet and are typically hosted by a third party. While they are convenient to use, they also come with the risk of being hacked or losing funds in case the third party is compromised.

- Hardware wallets: These wallets are physical devices that store your private keys offline. They are considered to be the most secure way of storing cryptocurrencies as they are not connected to the internet. However, they can be lost or damaged, and they may not be as user-friendly as other options.

- Mobile wallets: These wallets are apps that you can install on your smartphone. They are convenient to use and can be used on the go. However, they may not offer as much security as hardware wallets.

- Paper wallets: These wallets involve printing your private keys on a piece of paper. While they offer a high level of security, they can be easily lost or damaged if not stored properly.

It’s important to do your own research and choose the wallet that best meets your needs and preferences. Whether you’re a beginner or an advanced cryptocurrency user, understanding how different wallets work and how to securely manage your funds is crucial.

Blockchain education through resources like blogs, tutorials, and online courses can provide you with the necessary knowledge and skills to confidently use and store cryptocurrencies. By investing time in learning how to properly handle your funds, you can ensure their safety and minimize the risk of losing them.

Remember, the most important thing is to always be cautious and take the necessary precautions to protect your cryptocurrencies. With the right knowledge and tools, you can safely navigate the world of blockchain and cryptocurrencies.

How to Buy Gold with Bitcoin + Ethereum and 16+ more Cryptocurrencies

If you have a know-how of cryptocurrencies and wallets, you can use them to buy gold and other precious metals. By holding your own private keys in a self-custody crypto wallet, you have control over your funds and can securely make transactions. Here is how you can buy gold with Bitcoin, Ethereum, and more than 16 other cryptocurrencies:

- Choose a Wallet: To buy gold with cryptocurrencies, you will need a crypto wallet. There are different types of wallets, including desktop, mobile, and hardware wallets. Each type has its pros and cons, and it’s important to choose the one that best suits your needs.

- Set Up a Wallet: Once you have chosen your wallet, you need to set it up. This typically involves downloading the wallet software, creating a new wallet, and generating a unique wallet address.

- Connect Your Wallet to a Gold Provider: After setting up your wallet, you need to find a gold provider that accepts cryptocurrencies. Some gold providers have their own wallets, while others may require you to connect your existing wallet to their services.

- Choose the Cryptocurrency: Once your wallet is connected to a gold provider, you can choose the cryptocurrency you want to use for the purchase. Bitcoin and Ethereum are the most commonly accepted cryptocurrencies, but there are often a number of other options available.

- Complete the Transaction: After selecting the cryptocurrency, you can proceed with the transaction. This typically involves entering the amount of gold you want to purchase and confirming the transaction details.

- Verify and Confirm the Transaction: After submitting your transaction, it will be processed on the blockchain. Depending on the cryptocurrency you are using, this process may take some time. Once the transaction is confirmed, your gold purchase will be completed.

- Keep Track of Your Gold: Once you have bought gold with your cryptocurrencies, it’s important to keep track of your investment. You can use your wallet to monitor the value of your gold and track any changes in its price.

- Secure Your Wallet: Since you are using a self-custody wallet, it’s crucial to take appropriate security measures to protect your funds. Make sure to create a strong password, enable two-factor authentication, and keep your wallet software and operating system up to date.

When it comes to buying gold with cryptocurrencies, you have the flexibility and control to do it yourself using your crypto wallet. While custodial services are available and may be more convenient, they typically involve a third party holding your cryptocurrencies, which comes with its own risks. By following the steps outlined in this blog, you can securely buy gold and diversify your investment portfolio.

Frequently Asked Questions:

What are the different types of crypto wallets available?

There are several types of crypto wallets available, including hardware wallets, software wallets, and paper wallets.

What is a hardware wallet?

A hardware wallet is a physical device that stores a user’s private keys offline. It is considered one of the most secure ways to store cryptocurrencies as it is not connected to the internet.

What is a software wallet?

A software wallet is an application or program that is installed on a computer or mobile device. It allows users to store, send, and receive cryptocurrencies.

What is a paper wallet?

A paper wallet is a physical copy or printout of a user’s public and private keys. It is generated offline and provides a high level of security as it is not susceptible to online hacks.

Which type of wallet is the most secure?

Hardware wallets are considered the most secure type of crypto wallet as they store private keys offline and are not vulnerable to online attacks.

What is the main advantage of using a software wallet?

The main advantage of using a software wallet is the convenience it offers. It allows users to access their crypto assets from anywhere using a computer or mobile device.

Video:

Tangem is Trash! We should not use it! Review & Experiences on Tangem Crypto Wallet

What Are Crypto Wallets Explained! (Best Crypto Wallets)

Crypto Wallets Explained for Beginners | What are Crypto Wallets