When it comes to owning and managing Bitcoin, one of the most important aspects to consider is the security of your Bitcoin wallet. As the value of Bitcoin continues to rise, the risk of theft and loss becomes greater. In this article, we will discuss some tips and best practices to help you secure your Bitcoin BTC wallet.

Firstly, it is important to understand the different types of Bitcoin wallets available. There are two main types: hot wallets and cold wallets. Hot wallets are connected to the internet and are more vulnerable to cyber attacks. Cold wallets, on the other hand, are offline and offer a higher level of security.

When choosing a Bitcoin wallet, it is recommended to use a reputable and trusted wallet provider. Look for wallets that offer strong encryption, multi-factor authentication, and regular software updates. It is also a good idea to read reviews and do thorough research before making a decision.

In addition to choosing the right wallet, it is crucial to practice good security habits. One of the most important tips is to use a strong and unique password for your Bitcoin wallet. Avoid using common words or phrases and opt for a combination of uppercase and lowercase letters, numbers, and special characters. Additionally, enable two-factor authentication for an extra layer of security.

Overall, securing your Bitcoin BTC wallet requires a combination of choosing the right wallet provider and practicing good security habits. By understanding the different types of wallets, using a reputable provider, and implementing strong password and authentication measures, you can significantly reduce the risk of theft and ensure the safety of your Bitcoin investment.

- Hard Fork

- Understanding the Concept of a Hard Fork

- Potential Risks and Benefits of a Hard Fork

- Potential Risks:

- Potential Benefits:

- What is Bitcoin

- The Advantages of Using Bitcoin as a Digital Currency

- Gateway to the Digital Currency World

- Exploring the Possibilities of Digital Currency

- The Role of Bitcoin as a Revolutionary Payment System

- Types of Bitcoin Wallets

- The Advantages of Bitcoin as a Payment System

- Conclusion

- Get the Trust Wallet app now

- The Importance of Using a Reliable Bitcoin Wallet

- Overview of Trust Wallet’s Features and Benefits

- Some Key Terms

- Understanding Essential Concepts in the Bitcoin Network

- A Glossary of Commonly Used Bitcoin Terminology

- Frequently Asked Questions:

- What is a Bitcoin BTC wallet?

- How can I secure my Bitcoin BTC wallet?

- What are some best practices for securing a Bitcoin BTC wallet?

- Can I recover my Bitcoin BTC wallet if I lose access to it?

- Are there any risks associated with using a Bitcoin BTC wallet?

- What should I do if my Bitcoin BTC wallet is hacked?

- Video:

- The Safest Way To Store Bitcoin (Step By Step)

- The Best Ways To Store Small and Medium Amounts of Bitcoin

Hard Fork

A hard fork is a type of upgrade or change to the Bitcoin network’s protocol that is not backwards-compatible. This means that it creates a permanent divergence in the blockchain, resulting in two separate versions of the cryptocurrency.

There are different types of hard forks, including:

- Planned hard fork: This type of fork is prearranged and scheduled by the coin’s development team. It usually involves implementing significant changes to the protocol, such as improving scalability or adding new features.

- Contentious hard fork: A contentious hard fork occurs when there is a disagreement within the community or development team regarding the proposed changes. This can lead to a split in the network and the creation of two competing versions of the cryptocurrency.

- Emergency hard fork: An emergency hard fork is initiated to address critical security vulnerabilities or other major issues that require immediate action. This type of fork is rare and usually occurs to protect the integrity of the network.

When a hard fork occurs, it is important for Bitcoin holders to ensure their wallets are compatible with the new version of the cryptocurrency. Here are some tips to secure your Bitcoin BTC wallet during a hard fork:

- Keep your wallet software up to date: Make sure you are using the latest version of your wallet software to ensure compatibility with the forked blockchain.

- Research the fork: Stay informed about the planned hard fork and any wallet updates or recommendations from the development team. Take the time to understand the changes that will occur and how they may affect your wallet.

- Backup your wallet: Before the hard fork, it is essential to create a backup of your wallet’s private keys or seed phrase. This will allow you to recover your funds in case of any issues during the fork.

- Use a hardware wallet: Consider using a hardware wallet, such as a Trezor or Ledger, to store your Bitcoin. Hardware wallets provide an extra layer of security and are generally compatible with hard forks.

- Be cautious of scams: During a hard fork, scammers may try to take advantage of the confusion and deceive users into revealing their private keys. Be vigilant and only trust official sources for wallet updates and instructions.

- Wait for network stability: After a hard fork, it is best to wait for the new blockchain to stabilize before making any transactions. This allows time for any bugs or issues to be resolved.

By following these best practices, you can ensure the security of your Bitcoin BTC wallet during a hard fork and navigate any changes or challenges that may arise.

Understanding the Concept of a Hard Fork

A hard fork is a term often used in the world of cryptocurrencies, including Bitcoin (BTC). It refers to a significant and permanent divergence in the blockchain of a cryptocurrency, resulting in the creation of a new version of the cryptocurrency. This occurrence happens when the nodes or miners of a blockchain network can no longer agree on the rules and direction of the network.

When a hard fork takes place, a new set of rules is introduced, which are not compatible with the existing rules of the blockchain. As a result, a block is created that is not recognized by the old chain, leading to a split in the blockchain. This split can result in two separate cryptocurrencies, each with its own transaction history and set of rules.

To understand the concept better, let’s compare a blockchain to a wallet with different compartments. Each compartment represents a block, and the entire wallet represents the blockchain. In a hard fork, the wallet is divided into two separate wallets, each with its own set of compartments. The original wallet and compartments remain unchanged, while the new wallet and compartments follow the new set of rules.

One of the key points to note about hard forks is that they can potentially create multiple versions of a cryptocurrency. For example, when Bitcoin Cash (BCH) was created in a hard fork of Bitcoin, both Bitcoin (BTC) and Bitcoin Cash (BCH) existed as separate cryptocurrencies with their own blockchains and wallets.

Moreover, the creation of a hard fork can also result in the duplication of existing bitcoins, meaning that holders of the original cryptocurrency will also receive an equal amount of the new cryptocurrency created in the hard fork.

- Hard forks can occur due to disagreements among the community over scalability, security, or other aspects of the blockchain.

- Hard forks can lead to the creation of new cryptocurrencies with different features and objectives.

- Holders of the original cryptocurrency often receive an equal amount of the new cryptocurrency created in the hard fork.

In conclusion, a hard fork is a significant event in the world of cryptocurrencies that can lead to the creation of new cryptocurrencies with different rules and features. It occurs when the blockchain network splits into two separate chains due to disagreements among the network participants. Understanding the concept of a hard fork is essential for staying informed and making informed decisions in the dynamic world of cryptocurrencies.

Potential Risks and Benefits of a Hard Fork

A hard fork is a type of upgrade or update to a blockchain network that is not backward compatible, meaning it introduces changes that are not compatible with the existing protocol. This can create potential risks and benefits for the network and its users.

Potential Risks:

- Chain Split: A hard fork can lead to a chain split, where the blockchain diverges into two separate chains with different rules and protocols. This can result in divided communities and confusion among users.

- Security Vulnerabilities: Hard forks can introduce new security vulnerabilities that were not present in the original blockchain. Malicious actors can exploit these vulnerabilities to attack the network or steal funds.

- Loss of Consensus: Hard forks can create disagreements and conflicts within the community, leading to a loss of consensus on the network. This can hinder the progress and development of the blockchain.

- Reduced Liquidity: A hard fork can cause a split in liquidity, with some users preferring one chain over the other. This can result in reduced liquidity and trading volume for both chains.

Potential Benefits:

- Protocol Upgrades: Hard forks can allow for the implementation of new features, enhancements, and improvements to the blockchain’s protocol. This can enhance the functionality and usability of the network.

- Scaling Solutions: Hard forks can address scalability issues that might exist in the original blockchain by implementing new algorithms or mechanisms for processing transactions more efficiently.

- Community Engagement: Hard forks can generate interest and engagement within the community, as debates and discussions around the proposed changes take place. This can lead to a more active and involved user base.

- Increased Network Decentralization: Hard forks can result in the creation of new blockchains with different governance models and consensus mechanisms. This can increase network decentralization and promote diversity in the ecosystem.

Overall, hard forks can present both risks and benefits to a blockchain network. It is important for users and participants to carefully evaluate the potential implications and make informed decisions based on their individual needs and preferences.

What is Bitcoin

Bitcoin is a decentralized digital currency that was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. It is the first and most well-known example of cryptocurrency.

Bitcoin operates on a technology called blockchain, which is a distributed public ledger that records all transactions. The blockchain ensures transparency, security, and immutability of the Bitcoin network.

Types of Bitcoin wallets:

- Hardware wallets: These are physical devices that store your private keys offline. They provide an extra layer of security by keeping your keys isolated from the internet.

- Software wallets: These are applications that you can install on your computer or mobile device. They allow you to control your private keys and manage your Bitcoin transactions.

- Web wallets: These are online services that store your private keys on their servers. While convenient, web wallets are considered less secure as they are susceptible to hacking and other online threats.

Blocks and mining:

A block is a group of Bitcoin transactions that are bundled together and added to the blockchain. Each block contains a unique identifier, a list of transactions, and a reference to the previous block.

Mining is the process of adding new blocks to the blockchain. Miners use powerful computers to solve complex mathematical problems, and when a problem is solved, a new block is added to the blockchain. Miners are rewarded with newly created bitcoins for their efforts.

| Advantages of Bitcoin | Disadvantages of Bitcoin |

|---|---|

|

|

Overall, Bitcoin has revolutionized the world of finance by offering an alternative to traditional banking systems. It has gained popularity as a digital asset and a store of value, and its technology has inspired the development of numerous other cryptocurrencies.

The Advantages of Using Bitcoin as a Digital Currency

Bitcoin has gained significant popularity as a digital currency in recent years. It offers several advantages over traditional forms of currency and has become a preferred choice for many individuals and businesses. Here are some of the key advantages of using Bitcoin:

- Decentralization: Bitcoin operates on a decentralized network, which means that it is not controlled by any central authority or government. This decentralized nature provides users with a greater degree of financial freedom and avoids the risk of government interference or manipulation.

- Security: Bitcoin transactions are secured using cryptographic algorithms, making them highly secure and resistant to fraud or hacking attempts. Additionally, the use of digital wallets and block chains adds an extra layer of security, ensuring that your funds are protected at all times.

- Global Accessibility: Bitcoin can be accessed and used by anyone with an internet connection, regardless of their geographic location. This makes it an ideal currency for international transactions, as it eliminates the need for costly conversions and high transaction fees associated with traditional currencies.

- Privacy: Bitcoin transactions provide a certain level of privacy, as they do not require the disclosure of personal information. While transactions are recorded on the block chain, the identities of the users are not directly linked to their Bitcoin addresses, providing a certain level of anonymity.

- Low Transaction Fees: Bitcoin transactions typically have lower fees compared to traditional banking methods or credit card transactions. This makes it an attractive option for merchants and individuals who need to conduct frequent transactions.

- Ownership and Control: When using Bitcoin, you have complete ownership and control over your funds. You do not need to rely on a bank or financial institution to store or access your money. This eliminates the risk of funds being frozen or restricted by a third party.

- Transparency: Bitcoin transactions are recorded on a public block chain, which is accessible to anyone. This provides a high level of transparency and allows for auditing and verification of transactions. This transparency also helps to prevent fraud and corruption.

- Inflation Resistance: Bitcoin has a fixed supply cap of 21 million coins, making it resistant to inflation. Unlike traditional currencies that can be devalued over time due to excessive money printing, Bitcoin’s limited supply ensures its value remains relatively stable.

| Advantage | Description |

|---|---|

| Decentralization | Bitcoin operates on a decentralized network, providing users with financial freedom. |

| Security | Bitcoin transactions are secured using cryptographic algorithms. |

| Global Accessibility | Bitcoin can be accessed and used by anyone with an internet connection. |

| Privacy | Bitcoin transactions provide a certain level of privacy. |

| Low Transaction Fees | Bitcoin transactions typically have lower fees compared to traditional banking methods. |

| Ownership and Control | Bitcoin provides complete ownership and control over your funds. |

| Transparency | Bitcoin transactions are recorded on a public block chain, providing transparency. |

| Inflation Resistance | Bitcoin’s limited supply makes it resistant to inflation. |

Gateway to the Digital Currency World

The digital currency world has gained much attention and recognition in recent years, with Bitcoin being the most popular and widely accepted cryptocurrency. As more individuals and businesses adopt Bitcoin, the need to securely store and manage digital assets has become paramount. This is where Bitcoin wallets come into play.

Bitcoin wallets are digital tools that allow users to store, send, and receive Bitcoin. They serve as a gateway to the digital currency world, providing a safe and convenient way to manage your Bitcoin holdings. There are several types of wallets available, each with its own set of features and security measures.

Hardware Wallets: These wallets are physical devices that store your private keys offline. They offer the highest level of security as they are not connected to the internet and are resistant to hacking attempts. Hardware wallets are ideal for long-term storage of Bitcoin and are highly recommended for users who want to keep their assets safe from online threats.

Software Wallets: These wallets are applications that can be installed on your computer or smartphone. They are easy to use and provide a convenient way to access your Bitcoin holdings. However, software wallets are more vulnerable to malware and hacking attacks compared to hardware wallets. It is essential to ensure the security of your device and keep your software wallet up to date with the latest security patches.

Online Wallets: Also known as web wallets, online wallets are hosted on third-party platforms. They offer easy accessibility and can be accessed from any device with an internet connection. However, online wallets are generally considered less secure, as they rely on the security measures implemented by the hosting platform. It is crucial to choose reputable online wallet providers and enable two-factor authentication for added security.

Paper Wallets: Paper wallets involve printing out your private and public keys on a physical piece of paper. They offer a high level of security as they are not susceptible to online attacks. However, paper wallets require careful handling and storage to prevent loss or damage. It is essential to keep your paper wallet in a safe place, away from unauthorized access.

Mobile Wallets: Mobile wallets are applications designed for use on smartphones or tablets. They offer convenience and portability, allowing you to manage your Bitcoin on the go. Mobile wallets can be either software-based or hardware-based, depending on the app you choose. It is important to choose a reputable mobile wallet app and enable device security features such as PIN or fingerprint authentication.

In summary, Bitcoin wallets serve as the gateway to the digital currency world, providing a secure and convenient way to store and manage your Bitcoin holdings. It is essential to choose the right type of wallet that suits your needs and preferences. Whether you opt for a hardware wallet, software wallet, online wallet, paper wallet, or mobile wallet, implementing proper security measures is crucial to safeguard your digital assets.

Exploring the Possibilities of Digital Currency

As the world continues to embrace the digital revolution, the possibilities of digital currency are becoming increasingly apparent. One of the most well-known forms of digital currency is Bitcoin, which has gained popularity as an alternative form of payment.

Bitcoin is stored in wallets, which are digital containers that hold the user’s private keys. These wallets come in various types, each with their own advantages and level of security.

1. Hardware Wallets:

A hardware wallet is a physical device that stores Bitcoin offline. It provides the highest level of security and is not connected to the internet, making it virtually immune to hacking attempts. Hardware wallets often include additional security features, such as PIN codes and passphrase encryption.

2. Desktop Wallets:

Desktop wallets are software applications that are installed and run on a computer. They offer a convenient way to manage Bitcoin, but they are more vulnerable to malware or unauthorized access. It is crucial to use up-to-date antivirus software and follow best practices for computer security when using a desktop wallet.

3. Mobile Wallets:

Mobile wallets are apps that run on smartphones or tablets. They offer the convenience of being able to manage Bitcoin on the go. However, mobile devices are prone to loss, theft, or malware attacks. It is essential to enable strong security measures on the device and regularly update the wallet app.

4. Online Wallets:

Online wallets are hosted on the internet and can be accessed from any device with an internet connection. They are convenient and easy to use but are more susceptible to hacking attempts. When using an online wallet, it is crucial to choose a reputable provider and enable two-factor authentication.

5. Paper Wallets:

A paper wallet is a physical printout or handwritten note that contains the user’s private keys. It is an offline method of storing Bitcoin and provides a high level of security. However, paper wallets can be easily lost, damaged, or stolen, so it is essential to keep backups and store them securely.

Overall, there are various types of wallets available for storing digital currency like Bitcoin. Each type has its own advantages and risks. It is essential to research and choose a wallet that suits your needs and follows best practices for security to ensure the safety of your digital assets.

The Role of Bitcoin as a Revolutionary Payment System

Bitcoin, a decentralized digital currency, has emerged as a revolutionary payment system with the potential to disrupt traditional financial systems. It offers several advantages over traditional payment methods, including faster transactions, lower fees, and increased security. In this article, we will explore the role of Bitcoin as a revolutionary payment system and how wallets play a crucial role in its functionality.

Types of Bitcoin Wallets

Bitcoin wallets are digital tools that allow users to securely store and manage their Bitcoin holdings. There are several types of Bitcoin wallets available, each with its own unique features and levels of security:

- Hardware wallets: These wallets are physical devices that store the user’s private keys offline, away from potential online threats. They provide the highest level of security but can be more expensive.

- Software wallets: These wallets are software applications that users can install on their computers or smartphones. They offer a good balance between security and convenience.

- Web wallets: These wallets are hosted online and can be accessed from any device with an internet connection. They are convenient but carry a higher risk of hacking and theft.

- Paper wallets: Paper wallets involve printing the private keys and Bitcoin addresses on a physical piece of paper. They provide an offline storage option but require careful handling to avoid loss or theft.

The Advantages of Bitcoin as a Payment System

Bitcoin offers several advantages that make it a revolutionary payment system:

- Decentralization: Bitcoin operates on a decentralized network, meaning no single organization or authority has control over it. This eliminates the need for intermediaries, such as banks, and allows for peer-to-peer transactions without relying on a central authority.

- Lower transaction fees: Bitcoin transactions typically have lower fees compared to traditional payment methods. This is especially beneficial for international transactions, where traditional methods may involve high fees and lengthy processing times.

- Fast transactions: Bitcoin transactions can be processed within minutes, regardless of the sender or recipient’s location. This makes it a convenient payment method for both online and offline transactions.

- Security: Bitcoin employs advanced cryptographic techniques to secure transactions and wallets. As long as users take necessary precautions, such as securing their private keys, Bitcoin can offer a high level of security against fraud and theft.

Conclusion

Bitcoin has the potential to revolutionize the payment system by offering faster, more secure, and lower-cost transactions compared to traditional methods. Bitcoin wallets play a crucial role in ensuring the security and management of users’ Bitcoin holdings. By understanding the different types of wallets available and following best practices for secure storage, users can fully harness the benefits of Bitcoin as a revolutionary payment system.

Get the Trust Wallet app now

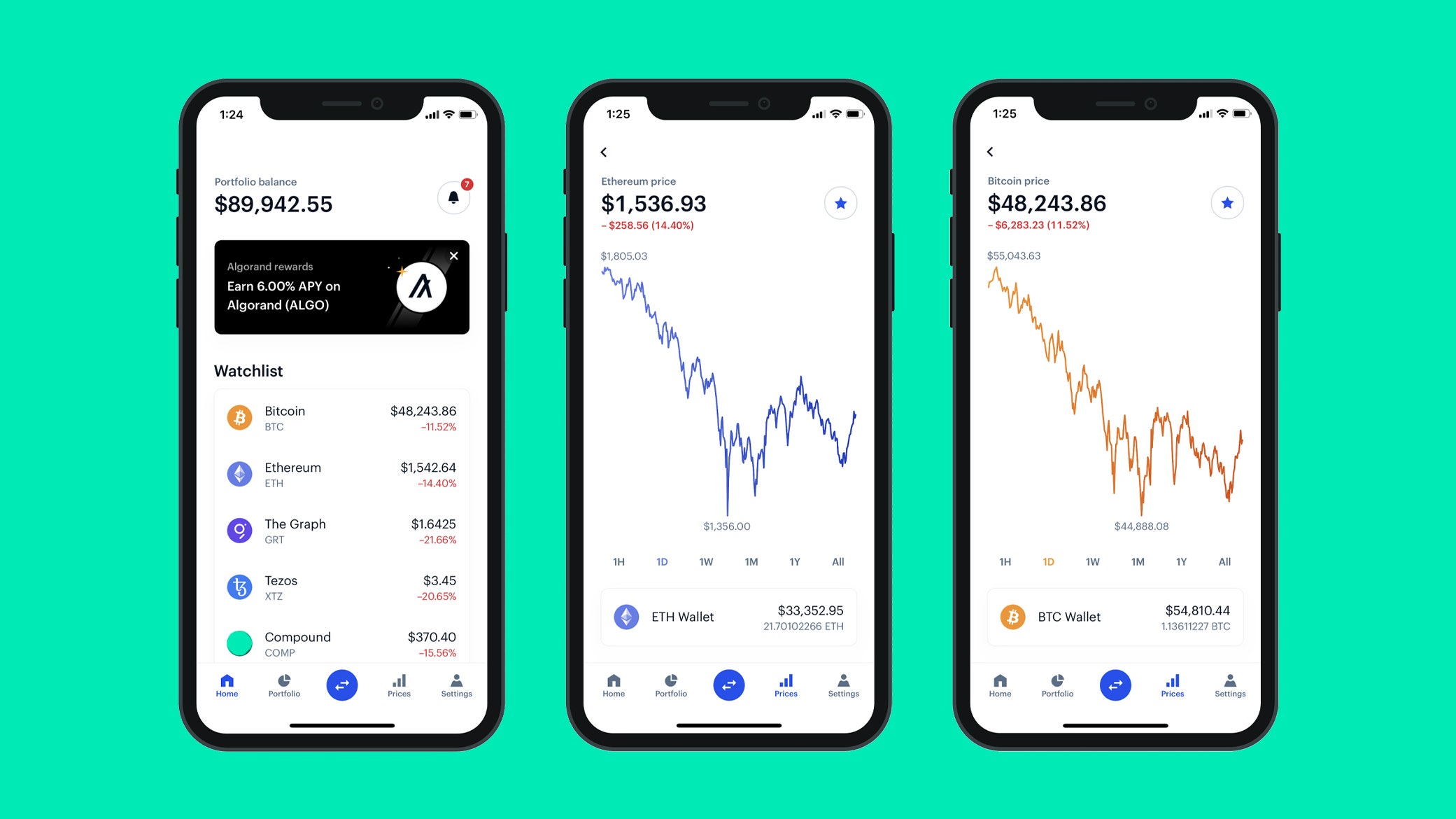

When it comes to storing and managing your Bitcoin BTC securely, having the right wallet is essential. With different types of wallets available, it’s important to choose one that suits your needs and provides reliable security.

One popular option is the Trust Wallet app, which offers a secure and user-friendly platform for managing your Bitcoin BTC. Whether you’re a beginner or an experienced user, the Trust Wallet app provides the tools and features you need to keep your digital assets safe.

Here are some reasons why you should consider using the Trust Wallet app:

- Security: Trust Wallet uses the latest security measures to protect your Bitcoin BTC from unauthorized access. The app encrypts your private keys and stores them locally on your device, so you have full control over your funds.

- User-friendly interface: The Trust Wallet app is designed to be intuitive and easy to use. You can easily navigate through your wallet, send and receive Bitcoin BTC, and track your transactions without any hassle.

- Compatibility: The Trust Wallet app is available for both iOS and Android devices. You can download it from the App Store or Google Play Store and start managing your Bitcoin BTC on the go.

- Support for multiple cryptocurrencies: In addition to Bitcoin BTC, Trust Wallet supports a wide range of other cryptocurrencies. You can manage all your digital assets in one place and easily switch between different currencies.

- Community support: Trust Wallet has a strong community of users who are always ready to help and provide assistance. You can join the Trust Wallet community and get support from fellow users.

If you want to take control of your Bitcoin BTC and ensure its security, download the Trust Wallet app now and start managing your digital assets with confidence.

The Importance of Using a Reliable Bitcoin Wallet

A Bitcoin wallet is essential for securely storing and managing your Bitcoin funds. With the increasing popularity and value of Bitcoin, it is crucial to choose a reliable wallet to ensure the safety of your digital assets. There are various types of wallets available, each with its own advantages and drawbacks.

Here are some key reasons why using a reliable Bitcoin wallet is vital:

- Security: A reliable Bitcoin wallet offers enhanced security features to protect your funds from potential threats such as hacking and theft. It uses encryption techniques to secure your private keys and ensures that only you have access to your Bitcoins.

- Convenience: A good Bitcoin wallet provides a user-friendly interface, making it easy to send, receive, and manage your Bitcoins. It should have clear instructions and seamless integration with other platforms, allowing you to effortlessly navigate through your transactions.

- Backup and recovery: Reliable wallets usually offer backup and recovery options to safeguard your funds in case of device loss or failure. This feature enables you to restore your wallet and access your Bitcoins from another device, ensuring that you never lose access to your funds.

- Compatibility: A trustworthy Bitcoin wallet should be compatible with different operating systems and devices, including desktops, laptops, smartphones, and hardware wallets. This compatibility ensures that you can access your funds and manage your Bitcoin portfolio from any device or platform.

- Community trust: Using a reliable Bitcoin wallet that has gained recognition and positive feedback from the Bitcoin community inspires confidence in the security and functionality of the wallet. It is advisable to do thorough research and read reviews before selecting a wallet.

By utilizing a reliable Bitcoin wallet, you can have peace of mind knowing that your digital assets are protected and easily accessible. Take the time to research and choose a wallet that suits your needs and aligns with your security preferences. Remember to regularly update your wallet software and follow best practices to keep your funds secure.

Overview of Trust Wallet’s Features and Benefits

Trust Wallet is a popular mobile wallet for storing and managing various types of cryptocurrencies, including Bitcoin (BTC). It offers a range of features that prioritize security and convenience for users.

- Secure Storage: Trust Wallet allows users to securely store their private keys and seed phrases on their own device, keeping them away from potential online vulnerabilities.

- Multi-Coin Support: In addition to Bitcoin, Trust Wallet supports a diverse range of cryptocurrencies, making it a versatile option for managing a diverse investment portfolio.

- Decentralized: Trust Wallet is a decentralized wallet, meaning that users have full control over their funds and are not dependent on a centralized authority.

- Simple User Interface: Trust Wallet provides a user-friendly interface that is easy to navigate, allowing both beginners and experienced users to access its features with ease.

- DApp Browser: Trust Wallet has its own built-in decentralized application (DApp) browser, which enables users to access and interact with various blockchain-based applications directly from the wallet.

- Security Measures: Trust Wallet employs top-notch security measures, such as encrypted backups, biometric authentication, and secure key storage, to keep users’ funds safe from unauthorized access.

- Token Integration: Trust Wallet supports the integration of new tokens, providing users with the ability to manage and store a wide range of digital assets.

- Exchange Integration: Trust Wallet allows users to connect to decentralized exchanges (DEXs) directly from the wallet, enabling them to trade cryptocurrencies securely and conveniently.

In summary, Trust Wallet offers a wide range of features and benefits that cater to the needs of cryptocurrency users. With its secure storage, multi-coin support, user-friendly interface, DApp browser, and strong security measures, Trust Wallet is a reliable option for managing and securing Bitcoin and other cryptocurrencies.

Some Key Terms

When it comes to securing your Bitcoin wallet, it’s important to understand some key terms. Here are a few that you should familiarize yourself with:

- Block: A block is a collection of Bitcoin transactions that are grouped together and added to the blockchain. It contains information about the transactions, such as the sender, receiver, and amount.

- Types: There are different types of Bitcoin wallets available, each with its own level of security. Some common types include hardware wallets, software wallets, and paper wallets.

Understanding these terms will help you better navigate the world of Bitcoin wallets and take necessary precautions to keep your funds secure.

Understanding Essential Concepts in the Bitcoin Network

In order to securely manage your Bitcoin BTC wallet, it is important to have a clear understanding of some essential concepts in the Bitcoin network. These concepts include blocks and types.

Blocks:

- A block is a collection of Bitcoin transactions.

- Each block contains a unique identifier called a block hash.

- Blocks are created by miners, who solve complex mathematical problems to validate and add transactions to the blockchain.

- Once a block is added to the blockchain, it cannot be altered or removed.

- Blocks are linked together in a chain, creating the blockchain.

Types:

- There are two main types of blocks in the Bitcoin network:

- Regular blocks: These blocks contain new transactions and are added to the blockchain approximately every 10 minutes.

- Orphan blocks: These blocks are created when two miners find a valid solution to the mathematical problem at the same time. Only one of these blocks can be added to the blockchain, while the other becomes an orphan block.

- Regular blocks contribute to the growth and security of the blockchain, while orphan blocks do not.

By understanding these essential concepts of blocks and types in the Bitcoin network, you can better understand how transactions are validated and added to the blockchain. This knowledge is crucial for securely managing your Bitcoin BTC wallet.

A Glossary of Commonly Used Bitcoin Terminology

- Bitcoin: A digital currency that enables peer-to-peer transactions without the need for a central authority.

- Wallet: A software program or hardware device that stores a user’s Bitcoin private keys and allows them to manage their funds.

- Types of Wallets: Different ways of storing and accessing Bitcoin:

- Hardware Wallet: A physical device that securely stores a user’s private keys offline.

- Software Wallet: A program that runs on a computer or mobile device and stores a user’s private keys.

- Web Wallet: A wallet that is hosted by a third-party service provider and accessed through a web browser.

- Paper Wallet: A physical printout or handwritten copy of a user’s private keys.

- Private Key: A secret alphanumeric code that allows a user to access their Bitcoin and authorize transactions.

- Public Key: A publicly available alphanumeric code that is used to receive Bitcoin.

- Address: A unique identifier associated with a user’s Bitcoin public key, used for receiving funds.

- Blockchain: A decentralized public ledger that records all Bitcoin transactions.

- Transaction: The transfer of Bitcoin value between addresses in the blockchain.

- Confirmation: The process of validating and adding a transaction to the blockchain.

- Mining: The process of verifying transactions and adding them to the blockchain by solving complex mathematical problems.

- Hash: A unique string of characters generated by applying a mathematical function to data, used to secure transactions in the blockchain.

- Wallet Backup: A copy of a user’s private keys or recovery phrase stored in a safe place to prevent loss of funds.

- Multi-signature: A feature that requires multiple private keys to authorize a Bitcoin transaction, increasing security.

- Cold Storage: Storing Bitcoin private keys offline, usually on a hardware device, for enhanced security.

- Fork: An event where a blockchain splits into two separate chains, often resulting in the creation of a new cryptocurrency.

Frequently Asked Questions:

What is a Bitcoin BTC wallet?

A Bitcoin BTC wallet is a digital wallet that allows you to store and manage your Bitcoin BTC securely. It acts as a personal bank account for your Bitcoin BTC, where you can receive, store, and send your digital currency.

How can I secure my Bitcoin BTC wallet?

There are several ways to secure your Bitcoin BTC wallet. Firstly, you can choose a wallet with strong security features, such as multi-factor authentication and encryption. Additionally, you should use a strong and unique password for your wallet and enable two-factor authentication if available. It is also important to keep your wallet software up to date and regularly backup your wallet.

What are some best practices for securing a Bitcoin BTC wallet?

Some best practices for securing a Bitcoin BTC wallet include using a hardware wallet, which is a physical device that stores your private keys offline, and using a strong password with a mix of uppercase and lowercase letters, numbers, and special symbols. It is also important to use reputable wallet providers and avoid clicking on suspicious links or downloading unknown software.

Can I recover my Bitcoin BTC wallet if I lose access to it?

If you lose access to your Bitcoin BTC wallet, it may be possible to recover it if you have created a backup of your wallet. This backup usually consists of a recovery phrase or a file that contains your private keys. By importing this backup into a new wallet, you can regain access to your funds. However, it is important to note that if you lose your backup and your private keys, it may be impossible to recover your wallet.

Are there any risks associated with using a Bitcoin BTC wallet?

Yes, there are risks associated with using a Bitcoin BTC wallet. One of the main risks is the potential for hacking and theft. If a hacker gains access to your wallet’s private keys, they can steal your Bitcoin BTC. Another risk is the possibility of losing access to your wallet, either due to forgetting your password or losing your backup. Additionally, there is always the risk of losing your funds due to technological failures or scams.

What should I do if my Bitcoin BTC wallet is hacked?

If your Bitcoin BTC wallet is hacked, it is important to take immediate action to protect your funds. Firstly, you should disconnect your device from the internet to prevent any further unauthorized access. Next, you should contact your wallet provider and inform them of the security breach. They may be able to assist you in recovering your funds or securing your wallet. Lastly, you should consider reporting the incident to the appropriate authorities.

Video:

The Safest Way To Store Bitcoin (Step By Step)

The Best Ways To Store Small and Medium Amounts of Bitcoin