When it comes to storing and managing your cryptocurrency, you have two main options – using a crypto wallet or an exchange. Both of them offer different features and benefits, so it’s important to know the differences between them to make an informed decision.

A crypto wallet is a digital wallet that allows you to securely store your cryptocurrencies. It comes in various types, including software wallets, hardware wallets, and online wallets. These wallets offer a high level of security, as they use encryption to protect your private keys from thefts and unauthorized access. Using a wallet enables you to have full control over your assets and make transactions directly from your wallet.

On the other hand, an exchange is an online platform where you can buy, sell, and trade cryptocurrencies against fiat currency or other cryptocurrencies. Exchanges are convenient for those who want to quickly and easily buy or sell cryptocurrencies, as they offer a wide range of trading options and features. However, using an exchange means that you are entrusting your assets to a third party, and there have been incidents of exchanges being hacked or going bankrupt, resulting in the loss of users’ funds. So, it’s important to choose a reputable exchange that has a good track record of security and reliability.

One of the most popular exchanges today is Binance, which offers a wide range of cryptocurrencies and low fees. It also has a user-friendly interface and provides additional features and programs, such as staking and lending, for users seeking additional ways to earn income from their cryptocurrencies. However, when using an exchange, you should be aware of the risks associated with the platform, especially if you plan to hold a large amount of cryptocurrencies or make significant withdrawals.

In conclusion, choosing between a crypto wallet and an exchange depends on your specific needs and preferences. If you want to have full control over your assets and prioritize security, using a wallet is the way to go. On the other hand, if you are more focused on convenience and trading options, an exchange might be the better choice. Regardless of your decision, it’s important to do thorough research and look for reputable platforms to ensure the safety of your cryptocurrencies.

- Crypto Wallet vs Exchange – A Comprehensive Comparison

- Purpose of Crypto Wallet and Exchange

- Wallet Purpose

- Exchange Purpose

- Security and Privacy

- Conclusion

- Wallet Security

- Exchange Security

- Control and Ownership of Funds

- Wallet Control and Ownership

- Exchange Control and Ownership

- Risk of Hacking and Loss

- Wallet Risk of Hacking and Loss

- Exchange Risk of Hacking and Loss

- Transaction Fees

- Wallet Transaction Fees

- Exchange Transaction Fees

- Availability of Cryptocurrencies

- Frequently asked questions:

- What is a crypto wallet?

- What is a crypto exchange?

- What are the advantages of using a crypto wallet?

- What are the advantages of using a crypto exchange?

- Which one should I use, a crypto wallet or a crypto exchange?

- Video:

- Crypto wallet and Exchange explained | wallet vs Exchange| Crypto currency full course | Episode – 3

Crypto Wallet vs Exchange – A Comprehensive Comparison

When it comes to managing cryptocurrencies, two popular options that users often consider are crypto wallets and exchanges. Both these platforms serve different purposes and provide unique features. In this comparison, we will analyze the key differences between them to help users make an informed decision based on their needs and preferences.

- Fees: One of the primary factors to consider is the fees associated with each platform. Exchanges typically charge fees for trading, depositing, and withdrawing funds. On the other hand, crypto wallets generally do not charge any fees for holding or storing cryptocurrencies.

- Security: When it comes to security, crypto wallets are often considered more secure. These wallets allow users to hold their private keys, giving them complete control over their funds. Exchanges, on the other hand, hold the private keys on behalf of the users, making them more vulnerable to hacks and thefts.

- Convenience: Exchanges are known for their convenience as they provide a wide range of services. Users can easily buy, sell, and trade cryptocurrencies using exchanges. Crypto wallets, on the other hand, are more suitable for users who only want to hold and store their cryptocurrencies securely.

- Currency Support: Exchanges typically support a wide range of cryptocurrencies, enabling users to trade various digital assets. Crypto wallets, on the other hand, may only support a limited number of cryptocurrencies.

- Fiat Transactions: Exchanges often facilitate fiat-to-crypto transactions, allowing users to buy cryptocurrencies using traditional currencies like USD or EUR. Crypto wallets, however, do not usually support fiat transactions.

- Programs and Offers: Some exchanges offer loyalty programs, referral programs, or promotional offers to attract users. Crypto wallets do not typically have such programs or offers associated with them.

- Public Perception: Exchanges, due to their high-profile nature and involvement in various cryptocurrency scandals, often have a mixed public perception. Crypto wallets, on the other hand, are generally seen as a safer option for storing cryptocurrencies.

Ultimately, the choice between a crypto wallet and an exchange depends on the user’s specific requirements. If you are seeking convenience and want to actively trade cryptocurrencies, an exchange may be the better option. However, if you prioritize security and want to hold your cryptocurrencies for the long term, a crypto wallet would be a more suitable choice.

Purpose of Crypto Wallet and Exchange

Crypto wallets and exchanges serve different purposes in the world of cryptocurrencies. While both are necessary for individuals seeking to transact with cryptocurrencies, they have distinct functionalities and features.

A crypto wallet is a digital application or device that enables individuals to securely store and manage their cryptocurrencies. Its primary purpose is to provide a safe and convenient way to hold cryptocurrencies for long-term storage or regular transactions. Wallets facilitate withdrawals, allowing users to send their cryptocurrencies from the wallet to other addresses.

An exchange, on the other hand, is a platform that allows individuals to buy, sell, and trade various cryptocurrencies. Its primary purpose is to provide a marketplace where users can exchange one cryptocurrency for another, or even convert them to fiat currency. Exchanges facilitate transactions between buyers and sellers, providing a wide range of trading pairs.

The most convenient way to use cryptocurrencies is by using both a wallet and an exchange together. Wallets are great for holding and securing cryptocurrencies, while exchanges provide the liquidity and convenience of converting cryptocurrencies into other assets or fiat currency.

When seeking to use cryptocurrencies for transactions, individuals can use their wallets to hold the cryptocurrencies they want to spend. The wallet generates a public address for the specific cryptocurrency, which they can share with others to receive payments or transfers. This address can be used in an exchange to convert the received cryptocurrencies into other assets or fiat currency.

It is important to know that some exchanges offer built-in wallets, allowing users to hold their cryptocurrencies within the platform. While this may seem convenient, it is generally recommended to use separate wallets for better security. Wallets that are not associated with exchanges provide more control and reduce the risk of losing funds in case of an exchange hack or other security breaches.

Furthermore, using an exchange wallet to hold cryptocurrencies may come with additional risks and fees. Some exchanges may charge fees for holding cryptocurrencies in their wallets, and users may have limited control over their private keys and the overall security measures implemented by the exchange.

In conclusion, crypto wallets and exchanges have different purposes in the world of cryptocurrencies. Wallets are primarily used for securely holding and managing cryptocurrencies, while exchanges offer the convenience of converting cryptocurrencies and enabling transactions with a wide range of trading pairs. It is often recommended to use separate wallets for better security and control over one’s funds.

Wallet Purpose

A crypto wallet is a digital tool that allows individuals to store and manage their cryptocurrencies. Its main purpose is to provide a secure and convenient way to hold and use digital assets. While there are various types of wallets available, they all share the fundamental goal of ensuring the safety and accessibility of cryptocurrencies for the user.

One of the most important advantages of using a wallet is the ability to make withdrawals. With a wallet, you have full control over your funds and can transfer them to any other wallet or exchange you choose. This gives you the freedom to move your assets wherever you want and use them for various purposes.

Wallets also provide a wide range of features and options that can enhance your cryptocurrency experience. For example, many wallets have integrated exchange services, which allow you to convert one cryptocurrency into another without leaving the wallet interface. This convenience can save you time and effort by eliminating the need to use external exchanges.

Moreover, wallets are designed to prioritize security. They are built with advanced encryption and authentication mechanisms to protect your private keys and funds from thefts and unauthorized access. By using a wallet, you can have peace of mind knowing that your cryptocurrencies are stored in a safe and secure environment.

Additionally, wallets come in various forms to cater to different user preferences. Some wallets are hardware devices that resemble USB drives, while others are software programs that can be installed on your computer or mobile device. Both types serve the same purpose of storing and managing cryptocurrencies, but they offer different levels of security and convenience.

It is worth noting that wallets are primarily used for cryptocurrencies and may not support fiat currency transactions. If you want to trade your digital assets for traditional currency, you will need to use an exchange. However, some wallets integrate with exchanges, allowing you to facilitate the conversion process within the wallet itself.

In conclusion, cryptocurrency wallets are essential tools for anyone seeking to hold and manage their cryptocurrencies. They enable secure storage, convenient transactions, and easy access to your digital assets. Whether you are a seasoned trader or a casual investor, using a wallet can enhance your crypto experience and provide you with greater control over your funds.

Exchange Purpose

An exchange is a platform that facilitates the buying and selling of different cryptocurrencies. The main purpose of an exchange is to provide a convenient and secure way for users to trade cryptocurrency. However, exchanges offer a wide range of additional features and services that make them more than just a trading platform.

One of the most common features offered by exchanges is the ability to hold and store cryptocurrencies in online wallets. These wallets enable users to securely store their digital assets and access them whenever they want. Some exchanges also offer offline or hardware wallets for those seeking additional security measures.

In addition to trading and wallets, exchanges also offer programs that allow users to earn rewards or interest on their cryptocurrency holdings. These programs often involve staking or lending cryptocurrency for a specified period of time and can be a way to earn additional money without actively trading.

Another important purpose of exchanges is facilitating the conversion between fiat currency and cryptocurrency. Most exchanges enable users to deposit fiat currency into their accounts and use it to buy cryptocurrencies. Likewise, users can sell their cryptocurrencies and withdraw the fiat currency back to their bank accounts. This feature is particularly useful for those who want to enter or exit the cryptocurrency market without going through multiple platforms.

Exchanges also play a vital role in the public visibility and adoption of cryptocurrencies. They often have a large user base and offer a wide range of trading pairs, making them a go-to platform for cryptocurrency enthusiasts. Their user-friendly interfaces and convenient features make it easier for newcomers to get started and explore the world of cryptocurrencies.

However, it is important to know that using exchanges comes with some risks. Thefts and hacks have been associated with exchanges in the past, so it is crucial to choose a reputable and secure platform. Additionally, exchanges often charge fees for their services, including trading fees, deposit fees, and withdrawal fees. These fees can add up, especially for frequent traders, so it is important to consider them when using an exchange.

| Exchange Purpose | Features | Risks |

|---|---|---|

| Facilitate cryptocurrency trading | Buying and selling cryptocurrencies | Theft and hacks |

| Provide cryptocurrency wallets | Securely store and access digital assets | |

| Offer rewards or interest programs | Earn additional money without trading | |

| Enable fiat-to-cryptocurrency conversion | Deposit and withdraw fiat currency | |

| Increase public visibility and adoption of cryptocurrencies | Large user base and user-friendly interface |

Security and Privacy

When it comes to security and privacy, crypto wallets and exchanges have different levels of protection.

Crypto Wallets: If you want to facilitate the secure storage of your cryptocurrencies, wallets are the way to go. These digital wallets hold your private keys, which are essential for accessing and managing your funds. With a wide range of wallet options available, you can choose the one that best suits your needs. Wallets enable you to have full control over your private keys and keep them offline, minimizing the risk of online hacks or thefts.

However, it’s important to know that wallets also come with certain risks. If you lose access to your private keys or forget your password, you may permanently lose your funds. Additionally, physical wallets can be lost or damaged.

Exchanges: Exchanges, on the other hand, offer a convenient way to hold and trade cryptocurrencies. They enable you to quickly buy or sell cryptocurrencies using fiat currency or other cryptocurrencies. This makes them the most common choice for those seeking to enter the world of cryptocurrencies.

However, when using exchanges, you have to trust them with the custody of your funds. While reputable exchanges like Binance have security measures in place to protect their users’ funds, using exchanges comes with some risks. Exchange hacks and thefts have occurred in the past, and there is always a possibility of security breaches or insider attacks.

In terms of privacy, wallets generally offer a higher level of privacy compared to exchanges. Wallets allow you to maintain full control over your personal information and transactions. On the other hand, exchanges often require users to go through KYC (Know Your Customer) procedures and may share user data with third parties or government authorities in compliance with regulations.

Conclusion

In the end, the choice between using a crypto wallet or an exchange depends on your security and privacy preferences. If you prioritize security and want full control over your funds, using a wallet is a safer option. On the other hand, if you value convenience and want to easily trade cryptocurrencies, exchanges are a viable choice. It’s important to assess the risks and benefits associated with each option before making a decision.

Wallet Security

When it comes to storing your cryptocurrencies, security should be your top priority. Crypto wallets offer a wide range of security features to protect your digital assets. Let’s take a closer look at some of the key security aspects to consider:

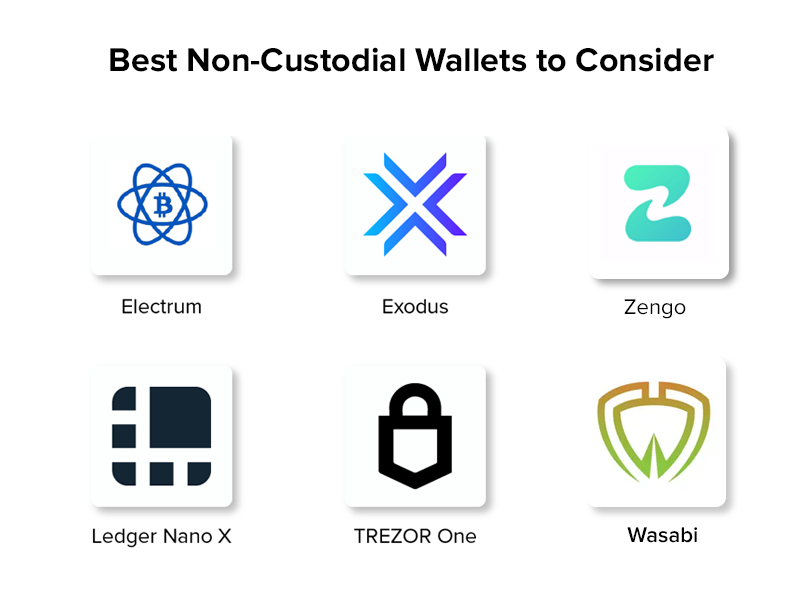

- Custodial vs. non-custodial wallets: Wallets can be categorized into two types – custodial and non-custodial. Custodial wallets, like those offered by exchanges such as Binance, hold your private keys on your behalf. Non-custodial wallets, on the other hand, provide you with full control over your private keys.

- Private keys: Private keys are essentially the keys to your cryptocurrencies. With a non-custodial wallet, you are the sole owner of these keys, giving you complete control and ownership over your digital assets.

- Backup: It’s crucial to have a backup of your wallet’s private keys or recovery seed phrase. This allows you to restore access to your wallet in case of loss or theft.

- Multi-factor authentication: Many wallets offer the option to enable multi-factor authentication, adding an extra layer of security to your account by requiring a second form of verification.

- Transaction verification: Wallets allow you to verify and approve each transaction before it is executed, ensuring that you have complete control over your funds and preventing unauthorized transfers.

- Secure hardware wallets: Hardware wallets are physical devices specifically designed to store cryptocurrencies securely. They offer enhanced security features like offline storage and encryption.

While exchanges can facilitate the buying and selling of cryptocurrencies, they might not always be the most secure option for holding your digital assets. Exchanges are more susceptible to hacks and thefts due to their wide user base and the fact that they hold large amounts of cryptocurrencies in their public wallets.

| Wallets | Exchanges | |

|---|---|---|

| Ownership | You own the private keys | You don’t own the private keys |

| Security | Offers a wide range of security features | More susceptible to hacks and thefts |

| Convenience | Allows you to hold and transact with multiple cryptocurrencies | Facilitates easy fiat withdrawals and cryptocurrency trading |

| Fees | Minimal transaction fees, if any | Trading fees and withdrawal fees |

It’s important to thoroughly research and choose a wallet that suits your needs and priorities. If you are seeking convenience and frequent trading, exchanges may be a suitable option. However, if you prioritize security and want full control over your digital assets, using a non-custodial wallet is recommended.

Exchange Security

The security of cryptocurrency exchanges is a critical concern for those seeking to facilitate transactions with cryptocurrencies. Exchanges are attractive targets for hackers due to the wide variety of wallets and currencies they hold. However, there are several security measures that exchanges have in place to protect their users’ funds.

- Programs and Technology: Exchanges employ advanced security programs and technology to safeguard user information and assets. They often use encryption techniques and multi-factor authentication to ensure the security of user accounts.

- Public Audits: Many exchanges undergo regular public audits to demonstrate their financial transparency and security measures. These audits provide an additional layer of trust and reassurance for users.

- Withdrawal Limits and Manual Approvals: Exchanges often have withdrawal limits in place to prevent large unauthorized withdrawals. Manual approvals may also be required for certain withdrawal requests, adding an extra layer of security.

- Insurance Coverage: Some exchanges offer insurance coverage to protect user funds in the event of a security breach or hack. This is an additional safety net that can help users recover their funds in case of theft.

- Two-Factor Authentication (2FA): Many exchanges offer the option of enabling two-factor authentication, which provides an extra layer of security by requiring users to verify their identity through a second method, such as a mobile app or SMS code.

- Secure Storage and Cold Wallets: Exchanges often employ secure storage methods, such as cold wallets, to protect users’ funds. Cold wallets are offline storage devices that are not connected to the internet, making them less susceptible to hacking attempts.

It’s important for users to understand the security measures associated with different exchanges. For example, Binance, one of the most widely used exchanges, offers a range of security features and has a good track record in terms of user funds’ safety.

While exchanges provide convenient platforms for buying, selling, and trading cryptocurrencies, it’s important to note that they are not meant for long-term storage. If you want to hold your cryptocurrencies for an extended period, it’s recommended to transfer them to a personal crypto wallet.

Using a crypto wallet provides users with full control over their funds and reduces the risk of thefts or hacks associated with exchanges. Wallets come in different forms, such as hardware wallets, software wallets, or online wallets. It’s essential to do thorough research and choose a reputable wallet provider before transferring your funds.

It’s worth noting that using a wallet may come with additional security risks, such as the possibility of losing access to your funds if you forget your password or lose your private keys. Therefore, it’s crucial to understand and follow best practices for wallet security.

In conclusion, exchanges offer a convenient platform for trading cryptocurrencies, but it’s important to be aware of the security measures they have in place and the risks associated with holding funds on exchanges. For long-term storage, using a reliable crypto wallet is generally considered a safer option.

Control and Ownership of Funds

One of the main advantages that crypto wallets offer is the control and ownership of funds. When you use a wallet, you have full control over your private keys, which are needed to access and move your funds. This means that you are the sole owner of your funds and you have the ultimate responsibility for their security.

On the other hand, when you use a crypto exchange, you are entrusting your funds to a third party. While most exchanges implement security measures to protect your funds, there is still a risk associated with storing your funds on an exchange. As we all know, exchanges have been hacked in the past, resulting in the loss of millions of dollars worth of cryptocurrencies.

For those who value security and control, using a crypto wallet is the way to go. With a wallet, you can store your funds offline, known as a cold wallet, or online, known as a hot wallet. Cold wallets are often considered the most secure option as they are not connected to the internet, making it nearly impossible for hackers to access your funds.

However, if you need to actively trade your cryptocurrencies or need access to other features that only exchanges can provide, then using an exchange may be a better option for you. Exchanges offer a wide range of trading pairs and have advanced features like stop-loss orders, margin trading, and lending programs.

It is important to note that using exchanges may come with fees and the need to go through identity verification processes. Additionally, if you are seeking to convert your cryptocurrencies to fiat currency, most wallets do not provide this option, whereas exchanges facilitate fiat withdrawals.

In summary, if you are looking for convenience and access to advanced trading features, using an exchange might be suitable for you. However, if security and full ownership of your funds are your main concerns, then using a crypto wallet is recommended.

Wallet Control and Ownership

When it comes to cryptocurrency, control and ownership of your currency is essential. With the increasing number of thefts and associated risks in the crypto world, it is crucial to have full control over your funds. This is where wallets play a significant role.

Wallets offer the convenience of storing and managing your cryptocurrencies securely. Unlike exchanges, which primarily serve as platforms for trading cryptocurrencies, wallets are dedicated programs that enable you to hold and transact with your currencies directly. They come in various forms, including desktop, mobile, and hardware wallets.

One of the advantages of using a wallet is that it allows you to have full control over your private keys. Private keys are unique codes that represent ownership of your cryptocurrencies. They are essential for authorizing transactions and accessing your funds. By having sole access to your private keys, you can be more confident about the security of your currencies, as it reduces the risk of thefts and unauthorized access.

On the other hand, when you use an exchange, you don’t have direct ownership of the private keys associated with your currencies. Instead, the exchange holds the keys on your behalf. While some exchanges offer the option to create a separate wallet within their platform, most only provide you with a public address to deposit your cryptocurrencies.

Using wallets also gives you the flexibility to manage a wide range of cryptocurrencies. Different wallets support various cryptocurrencies, allowing you to hold and transact with multiple coins. This is especially beneficial if you want to diversify your holdings or explore different investment opportunities in the cryptocurrency market.

Furthermore, wallets enable you to facilitate withdrawals and transfers without relying on third parties. Unlike exchanges, which may charge fees for withdrawals and transactions, wallets give you more control over such activities. You can choose the fees you want to pay and the network you want to use for your transactions, giving you more flexibility and potentially cost-saving options.

In summary, wallets offer control and ownership over your currencies, reducing the risks associated with thefts and unauthorized access. They provide a convenient and secure way to manage your cryptocurrencies, enable you to hold a wide range of coins, and facilitate withdrawals and transactions without relying on external parties. If you are seeking full control and ownership of your cryptocurrencies, using a wallet is the way to go.

Exchange Control and Ownership

When it comes to control and ownership over your cryptocurrencies, there are differences between crypto wallets and exchanges.

With crypto wallets, you have full control and ownership over your private keys. This means that you have complete control over your cryptocurrencies and can manage them as you see fit. You can easily access and use your cryptocurrencies using wallet programs, and you have the freedom to choose from a wide variety of wallets available.

On the other hand, when you use exchanges to hold your cryptocurrencies, you don’t have full control and ownership over your private keys. Instead, the exchange holds the private keys on your behalf. While this may be convenient for some users who don’t want to deal with the technical aspects of managing their own wallets, it also comes with certain risks.

Exchanges typically offer a user-friendly interface that allows you to easily buy, sell, and trade cryptocurrencies. They also facilitate transactions between different cryptocurrencies and with fiat currency. However, since exchanges hold your private keys, there is an associated risk of thefts and hacks. If an exchange gets hacked or goes bankrupt, you may lose access to your funds.

It is important to know that not all exchanges have the same level of security measures in place. Some exchanges have a history of security breaches, while others have implemented strong security features to protect users’ funds. Examples of reputable exchanges that have implemented strong security measures include Binance and Coinbase.

When it comes to fees, both wallets and exchanges have their own fee structures. Wallets typically have minimal fees, especially if you are using self-hosted wallets. On the other hand, exchanges generally charge fees for transactions, deposits, and withdrawals. These fees can vary depending on the exchange and the type of transaction you are performing.

In conclusion, if you are most concerned about control and ownership over your cryptocurrencies, using a wallet is the best option. Wallets enable you to hold your private keys and have full control over your funds. However, if you are seeking convenience and want to easily trade between different cryptocurrencies or with fiat currency, using an exchange may be a more suitable choice. Just keep in mind the security risks associated with exchanges and choose a reputable platform that has implemented strong security measures.

Risk of Hacking and Loss

When it comes to cryptocurrency, one of the major concerns is the risk of hacking and loss. Both wallets and exchanges are not immune to these risks, but they come with different levels of vulnerability.

Wallets, especially hardware wallets, are considered to be more secure compared to exchanges like Binance. Wallets store your cryptocurrency offline, making it difficult for hackers to access your funds. However, it is important to remember that if you lose your wallet or forget the private key, you may permanently lose access to your funds.

On the other hand, exchanges like Binance are online platforms that facilitate the buying, selling, and trading of cryptocurrencies. While exchanges offer convenience and a wide range of features, they are more vulnerable to hacking attempts. Binance, for example, has experienced security breaches in the past which resulted in the loss of millions of dollars worth of cryptocurrency.

Using an exchange exposes your cryptocurrency to potential hacking attempts as it requires you to store your funds on the platform. This means that if the exchange gets hacked, your funds could be at risk. Additionally, exchanges typically hold custody of your cryptocurrency and provide you with a digital representation or IOU of your holdings, rather than enabling you to directly hold the actual currency.

It is worth noting that there are certain measures you can take to minimize the risk when using exchanges. These include enabling two-factor authentication, using strong, unique passwords, and regularly monitoring your account for any suspicious activity.

In contrast, wallets offer more control over your funds as you are the sole custodian. Wallets store your private keys locally, ensuring that you have full ownership and control over your cryptocurrency. However, it is crucial to keep your wallet and private keys secure to prevent any potential loss.

In summary, if security and control over your cryptocurrency are your primary concerns, wallets, particularly hardware wallets, are the most secure option. However, if you prioritize convenience and are willing to accept the associated risks, exchanges may be more suitable for you.

Regardless of whether you choose wallets or exchanges, it is essential to do your research and choose reputable providers with a strong track record of security. Understand the risks and take necessary precautions to safeguard your cryptocurrency investments.

Wallet Risk of Hacking and Loss

When it comes to storing and managing cryptocurrencies, wallets and exchanges play a crucial role. Both options have their own advantages and risks, and it is important to understand them before making a decision. In this article, we will focus on the risks associated with using wallets.

Wallets enable users to hold their own cryptocurrencies and facilitate transactions without the need for a third party. They are often considered a more secure option compared to exchanges, as users have full control over their funds. However, there are still risks of hacking and loss associated with using wallets.

One of the main risks is the vulnerability of wallets to hacking attacks. Wallets, especially online or software-based ones, can be targeted by hackers who attempt to gain access to users’ private keys or passwords. If successful, hackers can transfer the funds to their own wallets, leaving the original owner with significant financial losses.

Another risk is the possibility of losing access to the wallet. If a user forgets or loses their password, recovery phrase, or private keys, they may not be able to access their funds. This can result in permanent loss of the cryptocurrencies stored in the wallet.

In addition, some wallets may have security vulnerabilities or bugs that could be exploited by hackers. It is important to choose a reputable wallet provider and keep the wallet software up to date to minimize the risk of such attacks.

Furthermore, phishing attacks are another way hackers can steal funds from wallets. Phishing attacks involve tricking users into revealing their wallet credentials through fake websites or emails. These attacks can be sophisticated and difficult to detect, making users more vulnerable to theft.

It is also worth mentioning that using wallets does not completely eliminate the risk of theft. If a user’s device gets infected with malware or keyloggers, it can compromise the security of their wallet and expose their private keys or passwords to hackers.

When choosing a wallet, it is important to consider the security features and reputation of the provider. Look for wallets that offer two-factor authentication, strong encryption, and have a good track record of security. It is also recommended to use hardware wallets for storing large amounts of cryptocurrencies, as they provide an extra layer of protection.

In conclusion, while wallets offer a more convenient and secure way to hold and transact with cryptocurrencies, they are not without risks. It is crucial to be aware of the potential risks of hacking and loss, and take necessary precautions to protect your funds. Regularly update your wallet software, use strong passwords, and be vigilant against phishing attacks to minimize the risk of theft.

Exchange Risk of Hacking and Loss

When using cryptocurrency exchanges like Binance, it is important to be aware of the risks associated with hacking and loss. While exchanges offer a wide range of features, such as trading and withdrawals, it is crucial to know the potential risks that come with using them.

One of the most common risks is the hacking of exchange platforms. Hackers target these platforms in an attempt to steal users’ cryptocurrencies. It is important to note that exchanges are not as secure as crypto wallets, as they are primarily designed to facilitate transactions and hold cryptocurrencies temporarily.

Exchanges have become a common target for hackers due to the large amount of digital assets stored in them. These platforms hold both cryptocurrency and associated fiat currency, making them attractive to thieves seeking to steal users’ funds.

To minimize the risk of hacking and loss, it is essential to choose a reputable and secure exchange. Binance is one of the most popular and trusted exchanges, offering various security programs to protect user funds. These programs include measures like two-factor authentication and withdrawal whitelisting, which ensure that only authorized users can access and withdraw funds.

Another important factor to consider is the fees associated with using an exchange. While exchanges are convenient for those who want to buy or sell cryptocurrencies quickly, they often come with fees for each transaction. Users should be aware of these fees and consider whether they are worth the added convenience.

In summary, while exchanges like Binance offer a wide range of features and convenience, it is important to be aware of the inherent risks associated with using them. Users should choose a reputable exchange and take necessary precautions to protect their funds. Additionally, understanding the fees associated with transactions can help users make an informed decision when using exchanges.

Transaction Fees

One of the most important factors to consider when choosing between a crypto wallet and an exchange is the transaction fees associated with each platform. Transaction fees can vary widely between different wallets and exchanges, and they can have a significant impact on your overall experience and costs.

Wallets enable you to hold and manage your cryptocurrencies, and they often come with their own transaction fees. These fees are usually charged for sending or receiving cryptocurrency to and from external wallets or addresses. Some wallets may also charge fees for converting between different cryptocurrencies or fiat currencies.

Exchanges, on the other hand, offer a wide range of services, including buying and selling cryptocurrencies using fiat currency. They often have their own transaction fees for trades, as well as fees for deposits and withdrawals. Additionally, some exchanges may charge fees for using certain features or programs they offer.

When it comes to transaction fees, it is essential to look for a wallet or exchange that offers transparent and competitive fees. You should consider the total cost of using the platform, including both upfront and hidden fees. Some platforms may advertise low fees but have additional charges for certain services or transactions.

It’s also important to know that transaction fees can vary based on the specific cryptocurrencies you’re using. Different cryptocurrencies have different fee structures and fee amounts, so it’s a good idea to research the fee structure of the cryptocurrencies you’re interested in before choosing a wallet or exchange.

Another important aspect to consider is that some wallets and exchanges have been associated with hacks and thefts that resulted in the loss of users’ funds. Therefore, it’s crucial to choose a reputable platform that prioritizes security and has a strong track record in safeguarding user funds.

In summary, if you primarily want to hold and facilitate transactions with cryptocurrencies, a wallet may be a convenient choice with lower fees. However, if you are seeking to trade between cryptocurrency and fiat currency, then an exchange like Binance may be a better fit, as it offers a wide range of services and competitive fees for trading, deposits, and withdrawals.

Wallet Transaction Fees

When it comes to cryptocurrency transactions, whether you are buying, selling, or transferring digital assets, transaction fees play a significant role. Wallets enable individuals to hold and manage their cryptocurrencies, allowing them to make transactions whenever they need to. However, it is essential to be aware of the fees associated with using wallets to facilitate these transactions.

Unlike exchanges, most wallets do not enable users to convert their cryptocurrencies into fiat currency. Therefore, if you are seeking to convert your digital assets into traditional currency, you will need to use an exchange. Exchanges are known to offer a wide range of programs and services to facilitate such transactions.

Looking at wallet transaction fees specifically, it is crucial to highlight that not all wallets charge fees for transactions. However, it is common for wallets to charge a small fee for every transaction made. These fees are necessary to ensure the security and timely confirmation of transactions on the blockchain.

One of the most well-known wallets in the market, the Binance Wallet, offers convenient and secure storage for a wide range of cryptocurrencies. Binance Wallet transactions, including withdrawals, come with associated fees. The fees vary depending on the specific currency being used, and the fees are typically deducted from the transaction amount.

| Cryptocurrency | Withdrawal Fee |

|---|---|

| Bitcoin (BTC) | 0.0004 BTC |

| Ethereum (ETH) | 0.005 ETH |

| Ripple (XRP) | 0.25 XRP |

It is important to note that wallet transaction fees may vary from wallet to wallet, and it is essential to research and compare different options to find the most suitable wallet for your needs. Some wallets may offer lower fees or even fee-free transactions for certain cryptocurrency transfers.

By understanding the fees associated with wallet transactions, users can make informed decisions about which wallets to use and how to manage their digital assets. Keeping an eye on transaction fees can help users avoid unnecessary costs and maximize the value of their cryptocurrency holdings.

In summary, while wallets provide a secure and convenient way to hold and manage cryptocurrencies, wallet transaction fees should be considered. By choosing a wallet with reasonable fees and exploring fee-free options, users can minimize costs and improve their overall experience with cryptocurrency transactions.

Exchange Transaction Fees

When it comes to buying, selling, or trading cryptocurrencies, most users turn to exchanges. Exchanges provide a convenient platform for users to trade various cryptocurrencies, but it’s important to consider the transaction fees associated with using them.

Exchanges typically charge fees for every transaction made on their platform. These fees can vary depending on the exchange and the type of transaction being performed. For example, fees for buying or selling cryptocurrencies can differ from fees for making withdrawals or transferring funds.

It’s important to note that not all exchanges charge the same fees. Some exchanges may offer lower fees compared to others, making them more attractive to users who frequently make transactions. It’s a good idea to research different exchanges and compare their fee structures before choosing one to use.

In addition to transaction fees, exchanges may also charge fees for depositing or withdrawing fiat currency. These fees can vary depending on the exchange and the payment method used. If you plan to regularly deposit or withdraw fiat currency, it’s important to be aware of these fees and factor them into your decision-making process.

While exchanges offer convenience and a wide range of trading options, they also come with risks. There have been instances of thefts and hacks targeting exchanges, resulting in the loss of user funds. It’s important to choose a reputable exchange with strong security measures in place to minimize the risk of such incidents.

If you are seeking a higher level of security for your cryptocurrencies, using wallets is a safer option. Wallets enable users to hold their cryptocurrencies in their own private wallets, reducing the risk of theft or hacking. However, using wallets may not be as convenient for those who frequently engage in trading and need quick access to their funds.

Overall, when deciding between using an exchange or a wallet, it’s essential to consider your specific needs and priorities. If you prioritize convenience and frequent trading, exchanges may be the better option for you. However, if security is your primary concern and you only want to hold your cryptocurrencies, using wallets may be a better fit.

Before choosing an exchange or wallet, it’s important to thoroughly research and understand the fees, security measures, and features offered by each platform. This will help you make an informed decision that best aligns with your individual requirements and goals in managing your cryptocurrency transactions.

Availability of Cryptocurrencies

When choosing between a crypto wallet and an exchange, one important factor to consider is the availability of cryptocurrencies. Both programs provide access to various cryptocurrencies, but there are some differences in terms of the range of options they offer.

If you are looking for a wide selection of cryptocurrencies, exchanges like Binance are a popular choice. Exchanges like Binance facilitate trading and offer a diverse range of cryptocurrencies, making it convenient for users seeking to hold or trade a variety of digital assets.

On the other hand, crypto wallets tend to focus on a smaller selection of cryptocurrencies. While most wallets support widely recognized cryptocurrencies like Bitcoin and Ethereum, they may not support the same breadth of options as exchanges.

It’s important to know that not all cryptocurrencies are easily available for transactions with fiat money (government-issued currency). Some cryptocurrencies can only be acquired through specific exchanges. Therefore, if you want to hold or trade a less common cryptocurrency, it may be necessary to use an exchange that supports it.

Additionally, using an exchange to store your cryptocurrency carries some associated risks. Public exchange platforms have been targets of thefts and hacks in the past. It is crucial to research the reputation and security measures of any exchange you consider using.

Crypto wallets, on the other hand, are generally considered a safer option for long-term storage of your digital currency. They offer secure storage and provide users with full control over their funds. However, it’s important to note that cryptocurrency thefts and scams can still occur if proper security measures are not followed.

Regardless of whether you choose a crypto wallet or an exchange, it’s essential to consider the fees associated with each option. Exchanges typically charge transaction fees and may have additional fees for withdrawals. On the other hand, most crypto wallets do not charge fees for holding or sending cryptocurrency, but there may be fees for certain features or transactions.

In summary, exchanges like Binance offer a wide range of cryptocurrencies and facilitate trading, making them suitable for users seeking a diverse selection of digital assets. Crypto wallets, on the other hand, provide a secure and convenient option for holding and managing your cryptocurrency in the long term.

Frequently asked questions:

What is a crypto wallet?

A crypto wallet is a secure digital wallet used to store, send, and receive cryptocurrencies. It contains a pair of cryptographic keys: a public key for receiving funds and a private key for signing transactions and accessing the funds.

What is a crypto exchange?

A crypto exchange is an online platform where users can buy, sell, and trade cryptocurrencies. It acts as an intermediary between buyers and sellers and facilitates transactions by matching orders and providing a secure platform.

What are the advantages of using a crypto wallet?

Using a crypto wallet provides users with full control and ownership of their private keys, ensuring a higher level of security for their funds. It also allows for offline storage options, making it less susceptible to hacking or online vulnerabilities.

What are the advantages of using a crypto exchange?

Crypto exchanges offer a convenient way to buy and sell cryptocurrencies. They provide liquidity, allowing users to easily trade different assets. Additionally, exchanges often offer advanced trading features and tools, making them suitable for active traders.

Which one should I use, a crypto wallet or a crypto exchange?

The choice between a crypto wallet and a crypto exchange depends on individual needs and preferences. If you prioritize security and control over your funds, a crypto wallet is recommended. If you frequently trade or require more advanced trading features, a crypto exchange may be more suitable.

Video:

Crypto wallet and Exchange explained | wallet vs Exchange| Crypto currency full course | Episode – 3